Current situation and future development trend of vacuum blood collection market: annual demand scale is around 20 billion tubes

The market research report "2022-2028 Global and Chinese Vacuum Blood Collection Market Status and Future Development Trends" provides a basic overview of the vacuum blood collection market, including definition, classification, application, and industry chain structure. It also discusses development policies and plans, as well as manufacturing processes and cost structures. It analyzes the development status and future market trends of the vacuum blood collection market, And analyze the main production areas, main consumption areas, and main producers of the vacuum blood collection market from the perspectives of production and consumption.

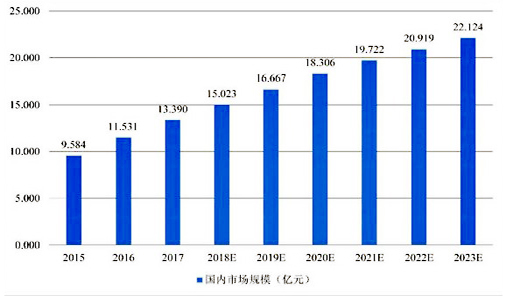

Conventional medical devices such as ordinary syringes and infusion sets are already in a mature market stage. The annual demand for vacuum blood collection vessels globally is around 20 billion units, and the actual sales scale in China in 2020 is about 2.7 billion units. The following is an analysis of the development trend of the vacuum blood collection industry.

The prevalence of vacuum blood collection is relatively high in developed countries, with a penetration rate of over 70%. The global growth rate is about 10%, higher than the overall 7.5% growth of medical devices; Developing China has become the biggest driving force for growth, maintaining an average annual growth rate of around 20% in recent years. The increase in penetration rates in developing countries such as China and India has become the fastest-growing market.

The development trend of the vacuum blood collection industry indicates that the demand in China's medical field has been showing a stable growth trend, which is the foundation for the steady growth of the medical industry. Structurally, due to the impact of healthcare reform policies, the growth rate of single visit drug costs has slowed down, and the growth rate of examination and treatment costs is faster. The use of new medical devices in the medical field will not only improve the overall level of diagnosis and treatment, but also promote the sustained and rapid growth of the overall medical device industry.

The use of vacuum blood collection vessels is extremely uneven in the distribution of hospitals at all levels in China, with the number of tertiary drugs accounting for only 6.37% of the total number of hospitals in the country. However, their demand for vacuum blood collection vessels accounts for 50% of the overall demand. This also means that a large number of grassroots hospitals have not used this product on a large scale. From the perspective of per capita usage level, developed countries such as Japan have a per capita usage of over 6 units per person per year, while China is currently expected to reach 2.5 units per person per year by 2013. The future demand space is very broad.

The characteristic of "packaging procurement" of medical devices can provide a free ride for vacuum blood collection. In the sales of medical devices, buyers often package and purchase various types of medical devices instead of single products, such as syringes, infusion sets, injection needles, gauze, gloves, surgical gowns, etc. The maturity of the international market for other medical devices has laid a good foundation for the foreign trade of vacuum blood collection.

The development trend of the vacuum blood collection industry points out that important international medical device companies entrust Chinese companies to manufacture and produce, and the products are mainly sold to the three countries of Germany and Japan. The Chinese manufacturing of medical devices has a certain international recognition, such as BD in the United States and NIPRO in Japan entrusting Shanghai Kangdeli to produce syringes, and OMI in Australia entrusting Zhejiang Shuangge to produce safety syringes.

The export volume of medical device products is huge. In 2020, the total import and export volume of medical devices in China reached 16.28 billion US dollars, a year-on-year increase of 28.21%. Among them, the export value was 11.067 billion US dollars, a year-on-year increase of 31.46%; The import value was 52.16 US dollars, a year-on-year increase of 21.81%. The foreign trade of medical devices continued to maintain a surplus, with a surplus of 5.851 billion US dollars, an increase of 1.718 billion US dollars compared to the same period.

Due to the increasing trend of infectious diseases such as mad cow disease and avian influenza spreading to humans, the World Health Organization and animal inspection and quarantine departments in most countries have also strengthened the prevention and monitoring of animal diseases. The promotion of vacuum blood collection in animal testing has also been recognized.

What are the prospects and investment opportunities for future industry market development? To learn more about the specific details of the industry, please click to view the report "2022-2028 Global and Chinese Vacuum Blood Collection Market Status and Future Development Trends". The report conducts specific investigations, research, and analysis on various factors related to the industry, gaining insights into the future development direction of the industry, the evolution trend of the industry's competitive landscape, as well as technical standards, market size, potential problems, and the crux of industry development. It evaluates the investment value and effectiveness of the industry, proposes constructive suggestions, and provides reference basis for industry investment decision-makers and business operators.